三星折叠屏手机供应商 三星折叠手机用京东方

热门文章

0

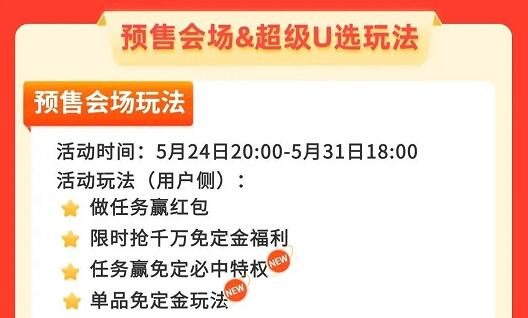

淘宝搜:【天降红包222】领超级红包,京东搜:【天降红包222】

淘宝互助,淘宝双11微信互助群关注公众号 【淘姐妹】

原标题:外媒:京东方或打入三星Galaxy折叠屏手机供应链 【环球网科技综合报道】2月22日消息,据韩媒报道,一位业内人士表示,三星电子目前正在与京东方非正式讨论关于折叠屏手机的合作,这一合作被解释为在外部不确定的竞争中选择了“价格竞争力”。 最新报道称,目前,两家公司正在秘密讨论工艺方法、面板厚度以及成品验证的时间。考虑到目前正处于开发能力验证阶段,短期内三星不会增加京东方面板的比例,但其间趋势发生变化是有意义的。 就可折叠显示器而言,三星电子迄今为止仅从三星显示器公司购买可折叠面板。如果该公司将京东方添加到供应链中,则可能意味着三星显示器公司的销售额将减少。 此外,在苹果供应链中,三星显示器和京东方似乎在争夺市场份额,根据最近的外媒报道表明京东方正在慢慢蚕食三星在苹果供应链上的市场份额。有外媒称,京东方甚至可能在明年获得首批 LTPO iPhone 面板订单。 而根据京东方在2月披露的投资者关系活动记录,京东方在本月接受机构调研时表示,2022 年,柔性 AMOLED 整体行业出货保持增长态势,在智能手机领域的渗透率持续提升,在笔记本电脑、车载等新应用领域崭露头角。 此外,京东方坦言,由于折旧压力以及安卓系客户产品的营利性大幅下降,公司柔性 AMOLED 事业业绩仍然承压。2023 年,随着公司柔性 AMOLED 业务的持续成长,以及客户端份额的持续增加,预计公司柔性 AMOLED 产品的出货量有望保持大幅增长;同时,公司将持续提升高端产品出货比例,提升产品组合盈利性,推动 LTPO、折叠、车载、IT 等新技术、新细分领域的加速增长,力争柔性 AMOELD 事业的业绩改善。 返回搜狐,查看更多 责任编辑:

外籍人在华工作完税证明 外籍人在华工作要开具完税证明吗

外籍人在华工作签证 辞退,外籍人在华工作可以办理退税吗,外籍人在华工作,外籍人在华工怎么办理After years of development, foreign talent has become a part of the labor market in China. It can be said that foreign talent is present in all industries in China, and they drive the development of Chinese society as much as our local Chinese talent. For foreign talents, does every foreigner in China need to pay taxes? How do foreign talents with four or six times the average social wage print their personal tax payment certificate when they have a change of business, etc.?经过多年的发展,外籍人才在中国已经成为劳动力市场的一部分,可以说,中国的所有的行业都有外国人才的身影,他们和我们中国本地人才一样,推动着中国社会的发展。对于外籍人才来说,每个在华的外国人都需要纳税吗?四倍、六倍社会平均工资的外籍人才发生变更等业务时要如何打印个人完税证明?Q1: Does every foreigner in China need to pay personal income tax?Q1:每个在华的外国人都需要缴纳个人所得税吗?According to the Individual Income Tax Law, according to the regulations, resident individuals are required to pay individual income tax in accordance with the relevant provisions of the Individual Income Tax Law of the People's Republic of China on income obtained from within and outside China. Then first, you need to determine whether the foreigner is a resident or non-resident individual.根据《个人所得税法》根据规定,居民个人从中国境内和境外取得的所得,均需要按照《中华人民共和国个人所得税法》的有关规定缴纳个人所得税。那么首先,需要先判断外籍人是居民个人还是非居民个人。A resident individual is an individual who has a residence in China or has no residence and has resided in China for a total of one hundred and eighty-three days in a tax year. A resident individual shall pay individual income tax on income derived from within and outside China in accordance with the provisions of this Law.在中国境内有住所,或者无住所而一个纳税年度内在中国境内居住累计满一百八十三天的个人,为居民个人。居民个人从中国境内和境外取得的所得,依照本法规定缴纳个人所得税。A non-resident individual is an individual who has no residence and does not reside in China, or who has no residence and resides in China for less than 183 days in a taxable year. A non-resident individual shall pay individual income tax on income derived from the territory of China in accordance with the provisions of this Law. The taxable year shall commence on January 1 and end on December 31 of the Gregorian calendar.在中国境内无住所又不居住,或者无住所而一个纳税年度内在中国境内居住累计不满一百八十三天的个人,为非居民个人。非居民个人从中国境内取得的所得,依照本法规定缴纳个人所得税。纳税年度,自公历一月一日起至十二月三十一日止。Q2: How do foreigners register and pay individual income tax?Q2:外国人如何注册和缴纳个人所得税?A2: Since foreigners need to register through face recognition, it is recommended to go to the nearest tax office to get the registration code to register and log in, which can be done in three easy steps.A2:因外籍人员需要通过人脸识别进行注册,所以建议就近前往办税服务厅获取注册码进行注册登录,轻松三步即可搞定。Step 1: Foreigners need to go to the tax office in person and register their personal document information and distribute the registration code after verifying with the window staff that the person's ID is the same.第一步:外国人需要本人前往办税服务厅,和窗口人员核对人证一致后,登记个人证件信息并派发注册码。Step 2: Open the Personal Income Tax App - go to "Personal Center" - click "Login/Registration "Select "Hall Registration Code Registration" and enter the registration code, document type, document number and name, etc.第二步:打开个人所得税APP――进入“个人中心”――点击“登陆/注册”――选择“大厅注册码注册”,输入注册码、证件类型、证件号码和姓名等信息。Step 3: After passing the verification, fill in the account number and cell phone number, enter the SMS verification code, and the registration is completed.第三步:通过验证后,填写账号和手机号码,输入短信验证码,注册即完成。Q3: How can foreigners print their personal income tax completion certificates?Q3:外国人如何打印个人所得税完税证明?A3:Login to the official website of the State Administration of Taxation. On the homepage, find the port of the declaration website, enter "Online Taxation", register your business, file online and complete tax payment.A3:登录国家税务总局官网。在主页上找到申报网站端口,进入“网上办税”,进行企业注册,在线申报,完成缴税。Q4: Can foreigners also enjoy the special additional deduction policy?Q4:外国人是否也可以享受专项附加扣除政策?A4: Starting from January 1, 2022, foreigners are no longer entitled to tax exemptions for housing allowance, language training fee and children's education allowance, and should enjoy special additional deductions according to the regulations.A4:自2022年1月1日起,外国人不再享受住房补贴、语言训练费、子女教育费津补贴免税优惠政策,应按规定享受专项附加扣除。Q5: What are the penalties for foreigners who do not pay personal tax?Q5:外国人不缴纳个税会受到什么处罚?A5: If foreigners violate the provisions of the Individual Income Tax Law and do not pay personal tax, the relevant authorities will pursue their legal responsibilities in accordance with the provisions of the Tax Levy and Administration Law and relevant laws and regulations. Foreigners who provide false information in serious cases will be included in the credit information system and subject to joint punishment.A5:外国人如果违反《个人所得税法》规定,不缴纳个税的,有关机关将依照《税收征收管理法》和有关法律法规的规定追究其法律责任。外国人提供虚假信息情节严重的,会被纳入信用信息系统并实施联合惩戒。

省和区的补贴可以一起领吗 警惕这笔补贴不能领已有多人上当

省和区的补贴可以一起领吗现在,省和区的补贴可以一起领吗,省内补贴,地区补贴工资是什么意思(来源:开封政法) 原标题:多人上当!这笔补贴不能领→ 近日 江先生的手机上收到一则 “2023年第一季度 个人劳动补贴申领通知”的邮件 点击邮件并按照要求扫码操作后 竟然被骗8万余元 江先生收到的邮件显示,根据国家财政部、国家税务总局、国家市场监督管理总局、工商行政管理局联合下发的《2023年财政第一季度个人劳动补贴》,申领工作已展开。此次领取限于全国范围内的合同工资所有者,收到通知后,请及时打开微信扫码办理,登记领取,逾期视为弃权领取。 江先生没有多想便扫描二维码,进入了所谓的“个人劳动补贴申领界面”, 按照指引输入了姓名、身份证号、银行账号、余额等相关信息。点击确认后,江先生又 连续四次输入手机号及收到的验证码,发现自己的银行账户被转账四笔,共计损失人民币8万余元。江先生这才醒悟过来,自己是中了骗子的圈套。 此类诈骗的核心,就是 利用伪造财政部官方信息,让人进入到骗子精心伪造的“网站”,并诱使受害者填写银行卡号、验证码等敏感内容。有了这些信息,骗子便可以轻易通过远程操作,将卡中的钱款转移。由于此类“网站”的操作界面 无论是标识排版还是内容都与官方网站几乎一样,一般人很难识别,所以骗子的成功率很高。根据公安机关掌握的情况,目前此类骗术正处于初始爆发期。 提醒: 收到类似 信息或邮件 要第一时间提高警惕,切勿轻易相信 领取任何补贴都无需提供 银行卡密码、手机验证码 来源:湛江政法 分享!点赞!在看!讲好政法故事返回搜狐,查看更多 责任编辑:

版权声明:除非特别标注原创,其它均来自互联网,转载时请以链接形式注明文章出处。